Foreign Property News | Posted by Shwe Zin Win

The Hongkong entertainment industry has been so badly affected by the coronavirus outbreak that a support programme had to be established to offer cash assistance to those in need (courtesy of HKPAG president and all-around good guy Louis Koo).

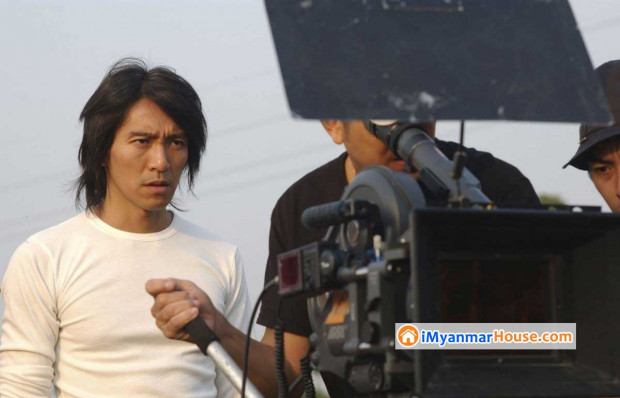

Recently, it was revealed that legendary actor-director Stephen Chow had mortgaged his hilltop house to J.P. Morgan Chase Bank in March this year. While some media outlets took this as a sign that the comedy icon could be struggling financially (which seems highly unlikely), others believe it might have been done in order to fund his next film project.

Making movies ain’t cheap

Like many of his affluent peers,Stephen is a keen investor in property and has even been dubbed the “King of Real Estate Speculation” as he has a knack for making very lucrative investments.

For instance, in 2004, he spent HK$210mil (S$37.8mil) on a shoplot in Tsim Sha Tsui, which was sold for HK$320mil (S$57.6mil) six years later, netting him a sweet profit of HK$110mil (S$19.8mil). The house that he recently mortgaged is one of four bungalows that he built with Ryoden Development along the exclusive Pollock’s Path on The Peak (fun fact: Pollock’s Path was once named the most expensive residential street in the world). Stephen acquired the property, aptly called Skyhigh, for HK$320mil (S$57.6mil) in 2004.

It’s the only building that he kept for himself while selling the other three for a whopping total of HK$1.45bil (S$261mil) in 2009 and 2011. Many interested buyers reportedly tried to bid for it over the years, but Stephen was never impressed enough with their offers to let it go.

This is apparently not the first time Stephen has mortgaged the same house, which is valued at HK$1.1bil (S$198mil). In 2011, he mortgaged it to HSBC and redeemed it just last year.

The latest transaction happened on March 13, which was when the COVID-19 outbreak in Hongkong was at its worst. According to Apple Daily, the mortgage was signed by Stephen’s older sister Kelly Chow, who is the Executive Director of investment holding company Bingo Group.

As for his reasons behind mortgaging his home so soon after redeeming it, Apple Daily contacted Stephen’s assistant for a clarification, but did not receive a response.

Well, no matter why he did it, one thing’s for sure: Trying to comprehend all that money he has spent and made over the years has made us feel very, very poor indeed.

4.jpg)

Ref: Stephen Chow Mortgaged His $198mil House When The COVID-19 Outbreak Was At Its Worst In Hongkong (edgeprop)